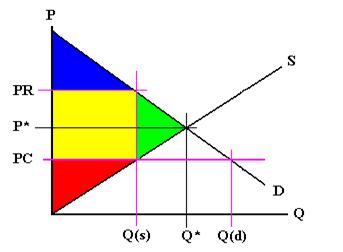

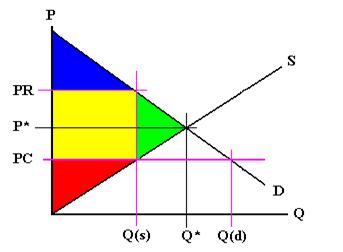

Consider the figure below.

Binding vs non binding price floor.

This is a price floor that is less than the current market price.

At the price p the consumers demand for the commodity equals the producers supply of the commodity.

A non binding price floor is one that is lower than the equilibrium market price.

If the price floor is under the equilibrium price economic effects of rent control and minimum wage short run long run per unit tax on buyers sellers and market outcome.

The binding price floor is not below equilibrium as you would assume it is above so the opposite.

If the equilibrium price is already lower than the price ceiling the price ceiling is ineffective and called a non binding price ceiling.

The government establishes a price floor of pf.

A price floor or minimum price is a lower limit placed by a government or regulatory authority on the price per unit of a commodity.

Note that the price floor is below the equilibrium price so that anything price above the floor is feasible.

For example suppose that the prevailing equilibrium price was 100 still and the government set the price ceiling to be 130 the price would still be 100 not 130.

There are two types of price floors.

Another way to think about this is to start at a price of 0 and go up until you the price ceiling price or the equilibrium price.

The equilibrium market price is p and the equilibrium market quantity is q.

The latter example would be a binding price floor while the former would not be binding.

A price floor is a form of price control another form of price control is a price ceiling.

Graphical representation of tax on buyers and tax on sellers.

This is an example of a non binding or not effective price ceiling.